The inventory market is a long-term funding. However precisely how lengthy is long-term?

To some, it’s not less than 5 years. To others, it’s 10 years minimal. And there are nonetheless just a few who would say it’s 15 years or extra.

Once I turned a registered monetary planner in 2012, I belonged to the “not less than 5 years” group. However in recent times, I’ve develop into extra conservative and began saying that one ought to be invested within the inventory marketplace for not less than 7 years; typically, I’d even advise 10 years.

The rationale for altering my view is especially due to how the Philippine inventory market has carried out since 2015. To be trustworthy, it hasn’t been good for the fairness market, although it’s not fairly apparent from the PSEI chart.

The PSEI has made quite a lot of beneficial properties since 1995. Nevertheless, it’s been shifting sideways since 2015, which explains why quite a lot of inventory portfolios and fairness fund values of those that began investing in 2015 or later are at the moment pink or adverse.

For example, if throughout the previous 7 years, you got a brand new VUL coverage or began peso price averaging on blue-chip corporations, then your portfolio might be exhibiting paper losses proper now, and it might have been pink for a number of years already.

That is understandably irritating.

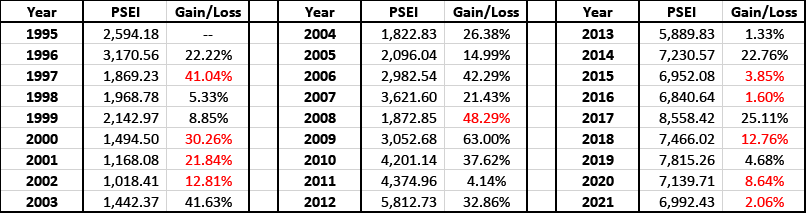

Historic Efficiency of the PSEI from 1995 to July 2021

Word:

- PSEI is the value of Philippine Inventory Change Composite Index on Dec 31 of specified 12 months

- Achieve/Loss is the % distinction of the PSEI value between Jan 1 and Dec 31 of the required 12 months

- 2021 PSEI value is from July 6

Trying on the desk above, you’ll see that when you invested within the PSEI initially of 2018, then by the top of that 12 months, your funding would have misplaced 12.76% of its worth.

And when you simply began investing within the Philippine inventory market or fairness fund in 2018 (or later), then I can’t be stunned in case your portfolio is pink proper now.

In reality, when you invested 100k initially of the 12 months someday between 2014 to 2020, you then’re most likely pondering that it was a mistake to put money into the inventory market.

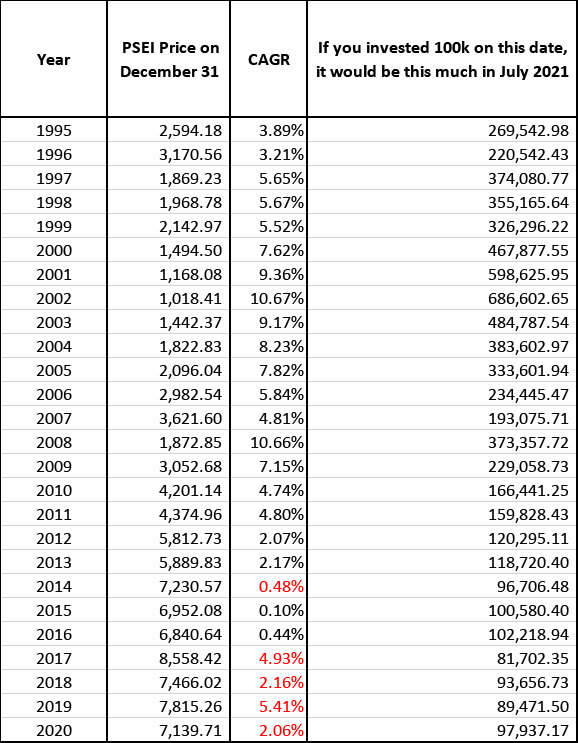

Word: CAGR is the Compounded Annual Progress Charge from Dec 31 of specified 12 months to July 6, 2021. This implies your 100k is compounding yearly by this a lot because you invested it. If it’s a pink quantity, then it’s been dropping cash yearly by that a lot.

From this desk, you’ll see that when you invested 100k on the final buying and selling day of December 2014, then in July 2021, that funding is barely price round 96k.

After nearly 7 years of letting your cash sleep within the inventory market, the worth of your shares has really gone down. Isn’t that annoying?

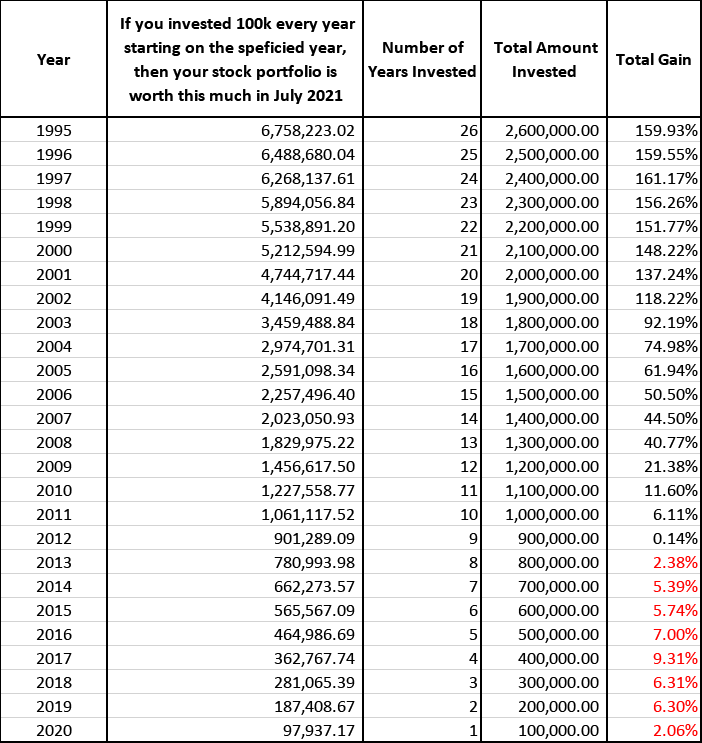

One other unhappy truth is that when you did peso price averaging and frequently invested 100k on the finish of yearly, then your portfolio would solely be optimistic when you began in 2012 or earlier.

What this desk exhibits is that, as an illustration, when you invested 100k on the finish of yearly from 2015 to 2020, you then would have invested a complete of 600k. Nevertheless, in any case these years, your funding is smaller and solely price round 565k on July 6, 2021.

And it’ll really feel such as you wasted your money and time by investing within the Philippine inventory market.

Why did I create these tables?

Throughout a current on-line inventory market investing seminar that I did, I discussed that my inventory market portfolio remained sturdy and optimistic regardless of the pandemic.

After my speak, I obtained an e-mail from somebody asking for the explanation why his inventory investments are a lot worse regardless of diligently investing and doing peso price averaging since 2014.

“Isn’t this purported to be optimistic already after 7 years?” he asks.

I looked for a logical reply to his query, and that’s once I realized that those that started passively investing in shares, fairness funds, and even balanced funds in 2014 or later, are unlucky victims of the sideways economic system of the nation.

I created these tables and did the calculations so I can have a greater view of what’s been taking place within the PSEI.

And because of this, I additionally started to grasp why quite a lot of younger buyers at the moment are taking their cash out of the native inventory market and pouring them into cryptocurrencies.

Moreover, as most likely triggered by the Gamestop brief squeeze in January 2021, a number of buyers I do know additionally modified their focus and began investing in U.S. shares and worldwide feeder funds.

Lastly, even a few of my associates who usually commerce Philippine shares have slowly shifted in the direction of world markets due to higher buying and selling alternatives in cryptocurrencies, foreign exchange, and U.S. shares.

What now?

In case you’re amongst those that had the initiative and braveness to transcend our native shores, then I need to congratulate you. You realized to adapt your monetary methods and alter your ship’s sails to the wind.

But when not, then there’s no must panic and promote, nor to worry that you just’re lacking out. The very last thing that you must do is to dive headfirst into different markets unprepared.

The factor is… I consider that the PSEI will finally rise once more.

And also you… we… we simply must be a little bit extra affected person.

There’s no must promote your shares nor to cease investing. In case you’re doing peso price averaging, you possibly can simply proceed so.

Nevertheless, I’d encourage you to broaden your information and be taught extra about investments and different such alternatives past our native market.

Discover how cryptocurrencies work. Uncover world funds. Understand how a feeder fund works. Try what’s taking place within the US inventory market.

There’s an enormous quantity of free assets on the market. Every thing it’s good to begin studying is obtainable on-line. So, carve out time to teach your self as a result of as self-made millionaire, Jim Rohn, as soon as stated, “Self-education will make you a fortune.”

What to do subsequent: Click on right here to subscribe to our FREE publication.

Share Tweet